Receive free UK interest rates updates

We’ll send you a myFT Daily Digest email rounding up the latest UK interest rates news every morning.

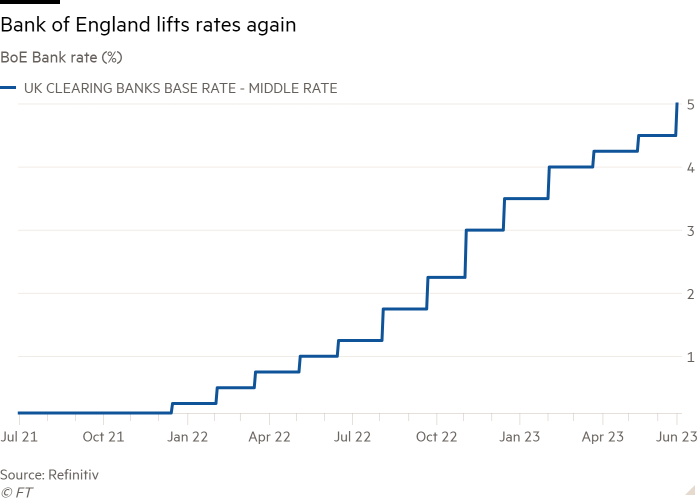

The Bank of England has stepped up its fight against persistent inflation with a surprise half-point rise in interest rates to 5 per cent, the highest level since 2008.

Voting seven to two in favour of the larger-than-expected increase, the central bank’s Monetary Policy Committee said it was responding to “material news” in recent economic data that showed stronger inflationary pressures in the UK economy.

The BoE hopes its decisive move will indicate a determination to get a grip on rapidly rising prices. In a letter to the chancellor explaining the decision, governor Andrew Bailey said: “Bringing inflation down is our absolute priority.”

With its 13th consecutive rate rise, the MPC defied market and most economists’ expectations of a quarter-point increase.

But it will reinforce financial market movements over the past month that have prompted lenders to withdraw fixed-rate mortgage rate deals and increase the costs of home loans substantially in what has become known as a mortgage “time bomb”.

Justifying the move, the MPC said: “There has been significant upside news in recent data that indicates more persistence in the inflation process.”

Bailey added that the decision had been taken “in light of stronger resilience in the UK economy and further evidence of persistence in inflation”.

Implementing such a large rate rise makes the BoE an outlier among other major central banks. Last week the US Federal Reserve skipped a rate rise for the first time in more than a year, while the European Central Bank implemented a quarter-point rise.

The boost to sterling from the BoE’s bigger-than-expected interest rate rise faded quickly. Having briefly risen to $1.2838, up 0.4 per cent against the dollar, it then traded 0.1 per cent lower at 1.2763.

UK government bond yields also fell despite the extra-large rate increase, with the two-year slightly lower at 5.03 per cent.

Heading into the decision, swap markets had indicated that a slim majority of investors expected a quarter-point rate rise, although the likelihood of a half-point rise had increased this week following the latest evidence of stubbornly high inflation.

The MPC made little comment on financial markets’ bets that interest rates would climb to a peak of around 6 per cent by the end of the year. Instead, the committee reiterated its previous commitment to tighten monetary policy further, “if there were to be evidence of more persistent pressures”.

In the minutes of the MPC meeting, the seven members who voted for the large increase pointed in particular to inflation data and labour market figures over the past six weeks, which had been significantly worse than they had predicted in early May.

Without updating those forecasts, the MPC minutes said annual private sector regular pay growth of 7.6 per cent in the three months to April was 0.5 percentage points higher than they had expected. Services inflation of 7.4 per cent in May was also half a percentage point higher than the bank’s models had predicted.

These forecast errors have caused the BoE significant embarrassment in recent weeks, with governor Andrew Bailey accepting the central bank had “lessons to learn” before it rushed out a review of forecasting models and communication.

Raising the interest rate to 5 per cent has already increased borrowing costs to a higher level than the BoE suggested would be the peak rate in its May forecasts.

Although the BoE still expects inflation to fall “significantly” in the rest of this year, the committee noted that “second-round effects in domestic price and wage developments generated by external cost shocks are likely to take longer to unwind than they did to emerge”.

The two members who dissented from the majority vote — Swati Dhingra and Silvana Tenreyro — voted to hold interest rates at 4.5 per cent. They said the effects of the rate rises already implemented “were still to come through” and this was sufficient to offset recent signs of more persistent inflation.