Bitcoin Cash (BCH) just marked a significant milestone in its lifecycle. The cryptocurrency has recently undergone its halving event at a block height of 840,000.

This once in a 4-years event finished in the early morning Asia time.

Bitcoin Cash Price Climbs Back to $619 After Dip

The recent halving reduced Bitcoin Cash miners’ rewards from 6.25 BCH to 3.125 BCH. While halvings generally coincide with price increases, BCH experienced a sharp decline.

Industry experts had anticipated the possibility of this drop. On April 1, Aaryamann Shrivastava, an analyst at BeInCrypto, forecasted a 14% drawdown for BCH following the event.

Read more: Bitcoin Cash (BCH) Price Prediction 2024/2025/2030

Shrivastava predicted a downward trajectory for BCH, suggesting that profit-taking would lead the cryptocurrency to lose its support at $650 and further slip to $625. The prediction indicated that breaking this support level would lead BCH to fall to $572, marking a 14% decrease.

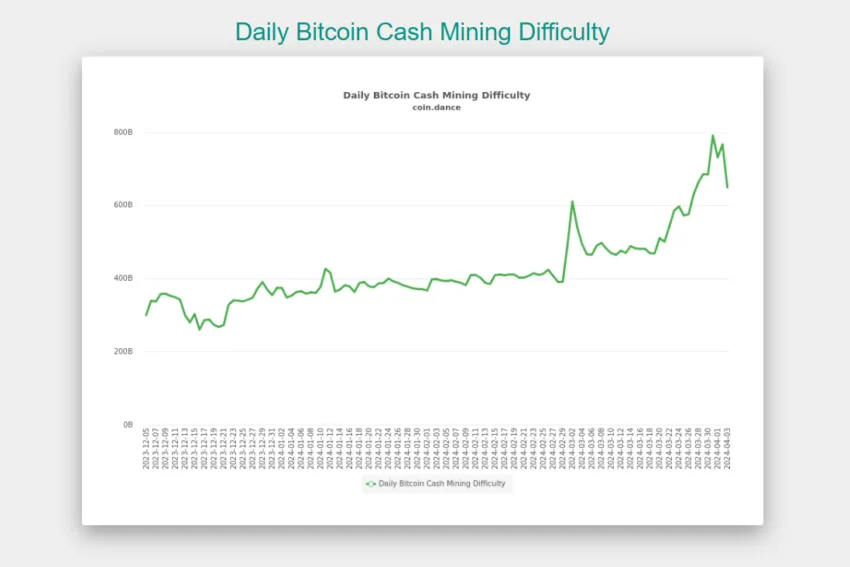

Meanwhile, David Shares, a well-known figure within the Bitcoin Cash community, attributed the price drop to a decrease in mining hashrate. Miners had shifted their focus to Bitcoin (BTC) in anticipation of the halving. This shift slowed down block production times on the BCH network until the difficulty algorithm could adjust.

“[The hashrate drop] also caused the price of BCH to drop suddenly to about $565 USD low for the day,” David Shares explained.

Yet, as of the time of writing, BCH has seen a recovery, trading at $619. Still, it’s important to note that BCH is trading 83.8% below its all-time high of $3,785, achieved in December 2017.

Read more: Bitcoin Cash: A Complete Guide to What It Is and How It Works

Bitcoin, the original cryptocurrency from which Bitcoin Cash forked, is also set to undergo a halving in April. However, analysts suggest the upcoming Bitcoin halving might diverge from past patterns. Increasing institutional adoption and the success of spot Bitcoin exchange-traded funds (ETFs) in the US are expected to play a role in making this halving unique.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.