Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Last month, the UK’s Conservative government stole the Labour party’s thunder by abolishing the historic “non-dom” tax status for foreigners living in Britain. Politics aside, the Tories claimed a pragmatic motivation: it gave them the chance to fashion a replacement residence-based regime. On Tuesday, Labour declared that its version would diverge from that blueprint. It plans to close loopholes that had been deliberately left open.

Labour said it accepted most aspects of UK chancellor Jeremy Hunt’s plan. Tax breaks would be offered to new arrivals rather than those whose domicile — or permanent home — is abroad. There would be a four-year window during which new arrivals would not pay UK tax on their foreign income and capital gains. Similarly, there would be a 10-year window for inheritance tax.

But the sweeteners designed to ease the transition to the new system would be scrapped by Labour. There would no longer be a 50 per cent discount on tax related to foreign income in the first year of the new rules. Nor would there be an option to shield foreign assets from inheritance tax by setting up an offshore trust before April 2025.

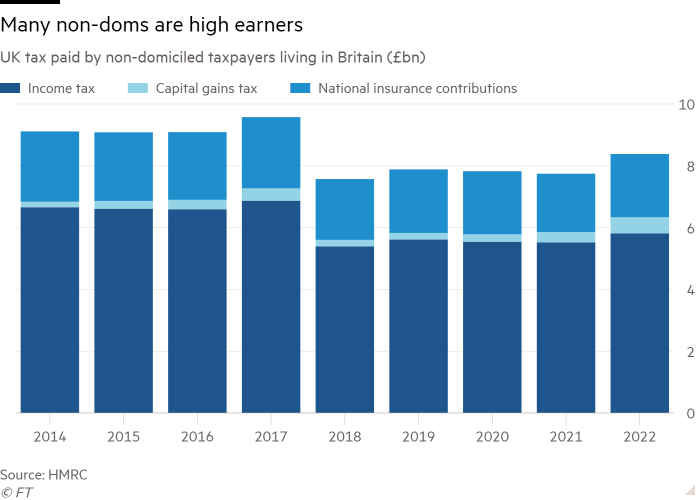

Labour expects to collect a one-off £600mn from the first of these measures, together with an extra £430mn a year in inheritance tax. That is in addition to the changes announced by Hunt, which were forecast to raise £3bn per year after the transition period. The change would be significant for the small group affected by the non-dom reforms — estimated at 5,500 people.

The City of London is likely to be affected by alterations to non-dom rules. Almost a quarter of non-doms work in finance, according to analysis by academics from the University of Warwick and the London School of Economics. They are also well-represented in professional, scientific and technical jobs — in particular management consultancy and accountancy.

Estimating how many will leave involves large amounts of guesswork. Many non-doms have compelling ties to Britain, though high earners often have homes in many countries. Countries such as Spain, Italy and Switzerland have been rolling out the welcome mat to wealthy footloose individuals. Italy’s “svuota-Londra” tax measures are particularly generous.

At the time of the Budget, the Office for Budget Responsibility suggested up to a fifth of non-doms ineligible for the new regime would leave the UK. But that assessment was based on the generous protections planned by Hunt to minimise impact. Removing those concessions leaves little to soften the blow — though the ingenuity of tax planners should never be discounted.