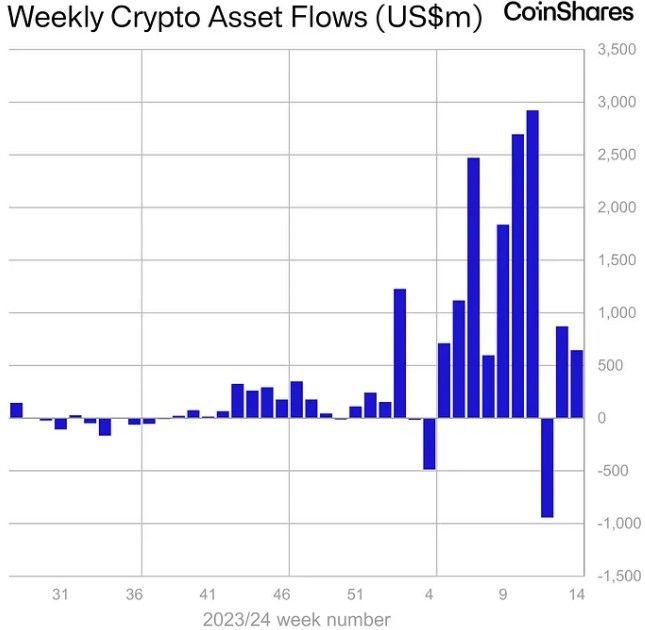

(Kitco News) – Digital asset investment products recorded $646 million worth of inflows last week as sentiment in the crypto market remained high despite the sideways price action for Bitcoin (BTC) over the past month.

The flows for crypto funds have noticeably slowed compared to the influx seen after the launch of spot BTC ETFs in the U.S., but the trend remains positive as most days see inflows into “The Nine” ETFs while outflows from Grayscale’s GBTC have slowed considerably.

“Inflows year-to-date at US$13.8bn are at their highest ever level, now far surpassing the US$10.6bn seen in 2021,” said James Butterfill, head of research at Coinshares. “Despite this, there are signs that appetite from ETF investors is moderating, not achieving the weekly flow levels seen in early March, while volumes last week declined to US$17.4bn for the week compared to US$43bn in the first week of March.”

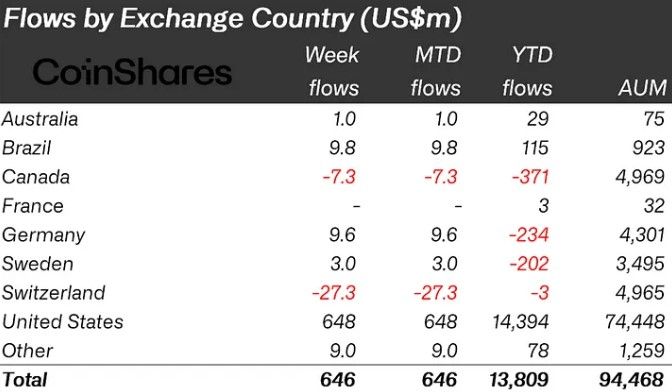

The U.S. continued to dominate from a regional perspective, recording $648 million worth of inflows, while Brazil, Germany, and Hong Kong saw inflows of $10 million, $9.6 million, and $9 million, respectively.

Switzerland and Canada were the only countries to record outflows, losing $27 million and $7.3 million, respectively.

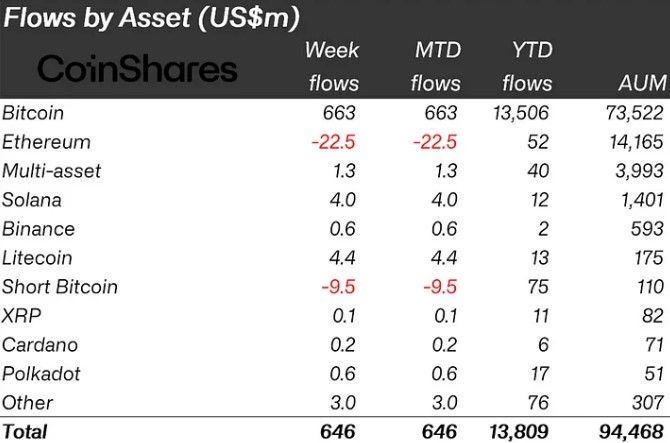

“Bitcoin remains the focus, seeing inflows totaling US$663m, while short-bitcoin investment products saw outflows for the 3rd week in a row totaling US$9.5m, suggesting minor capitulation amongst bearish investors,” Butterfill said.

Ethereum (ETH) recorded its fourth consecutive week of outflows totaling $22.5 million after analysts lowered the likelihood of an ETH ETF being approved in May below 30%. “This was in contrast to most other altcoins which continue to see inflows,” said Butterfill. “Notable were Litecoin (LTC), Solana (SOL), and Filecoin (FIL), seeing inflows of US$4.4m, US$4m and US$1.4m respectively.”

With the Bitcoin halving now only 11 days away, sentiment in the crypto ecosystem remains in ‘Extreme Greed’ territory according to data provided by Alternative.

While most analysts agree that the price action post-halving will be volatile, the consensus is that the trend will be higher as history shows the crypto market enjoys a healthy bull market that can last for six to eighteen months after the halving takes place.

A brief history of #BTC rallies prior to and after the Halving event:

Pre-Halving 1: +636%

Post-Halving 1: +8950%Pre-Halving 2: +414%

Post-Halving 2: +4000%Pre-Halving 3: +344%

Post-Halving 3: +623%$BTC tends to rally most AFTER the Halving event#Crypto #Bitcoin pic.twitter.com/ahWVFPodGe— Rekt Capital (@rektcapital) December 26, 2022

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.