Crypto wallet | Image:Unsplash

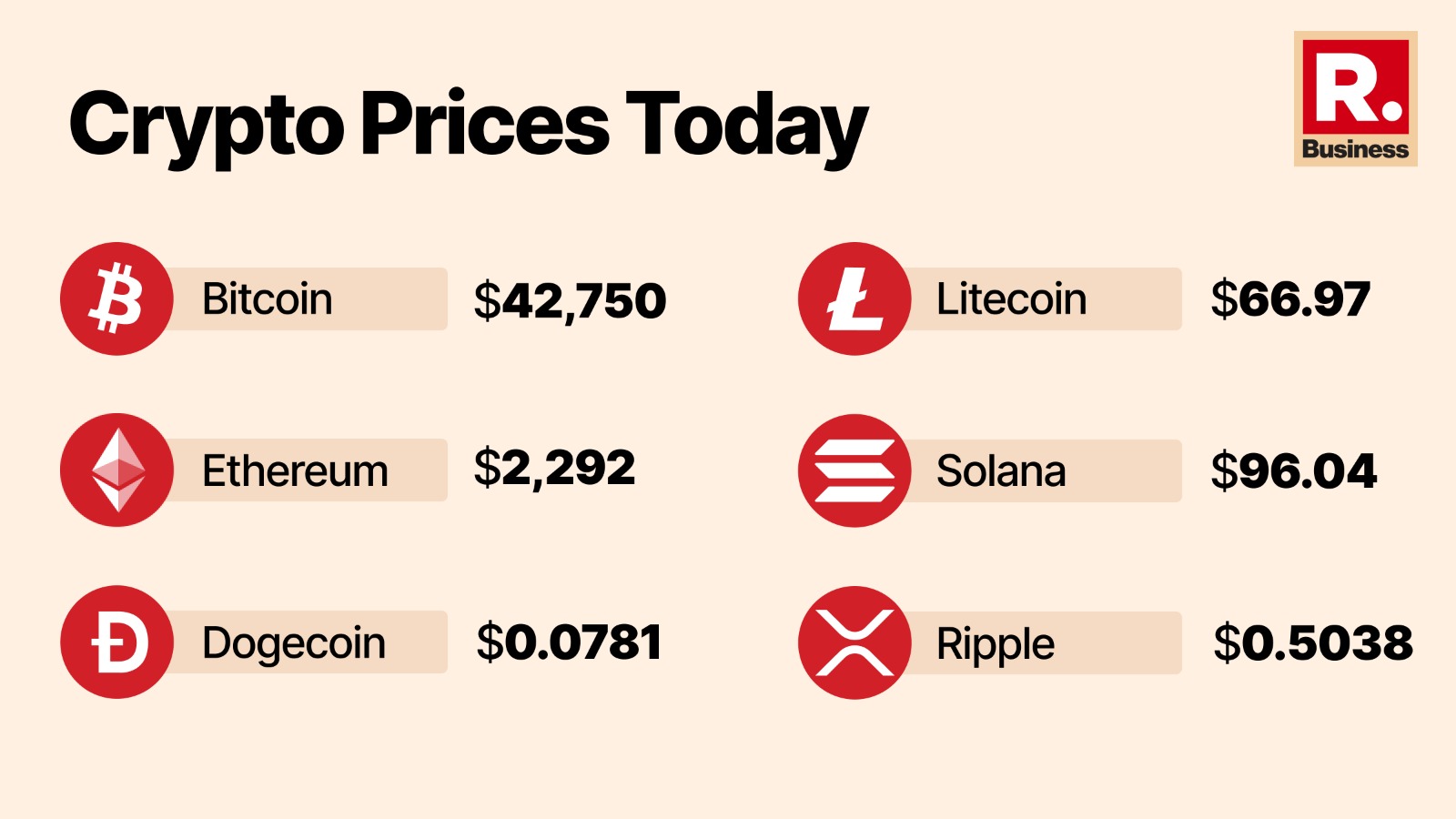

Crypto market overview: The crypto market has seen a minor correction in the last 24 hours with Bitcoin, Ethereum, and other leading cryptocurrencies recording marginal dips. The market capitalisation of the market also dipped by 0.34 per cent to $1.64 trillion, according to CoinMarketCap data.

On the other hand, BNB has observed a 1.65 per cent increase and Ronin token has gained more than 15 per cent in the last 24 hours.

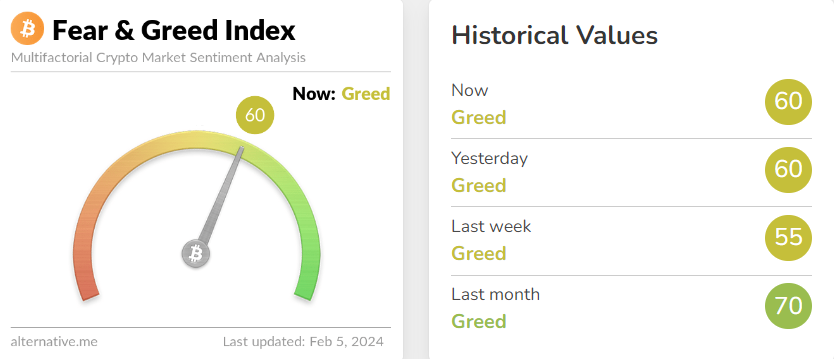

The Crypto Fear and Greed Index remained stable over the weekend and currently maintains 60 points in in Greed section of the index.

Image credit: Alternative.me

While talking to Republic Busines, CoinDCX Research Team said, “Over the weekend, the crypto market had a small dip. BTC stayed in the range of $41,000 to $45,000, showing some support from the moving averages. Clearing $45,000 could bring a strong upward trend. Positive factors like the halving make the outlook for BTC positive. ETH also had a mild dip and is in the range of $2,175 to $2,400. It’s below key moving averages, but developments like the Dencun upgrade and speculation on an ETH spot ETF approval give positive sentiments,”

Rajagopal Menon, Vice President, WazirX, said “Recent news of no rate cuts in March has cast a shadow on market sentiment, resulting in a decline in Bitcoin prices. Presently, Bitcoin stands at $42,395.08, marking a 1.38 per cent decrease in the last 24 hours. Ethereum follows suit, trading at $2,279.04, experiencing a 0.99 per cent dip during the same period.”

“Examining technical indicators, Bitcoin’s MACD has hit 36, indicating positive investor interest and a robust demand for the token. Ethereum, post a significant sell-off, retains its support level amidst cautious market sentiments. Bitcoin is currently facing resistance at the $42,500 level, marking a pivotal moment in its price action, while the $39,000 mark holds crucial support.” added Menon.

“Highlighting Bitcoin’s range-bound movement in the last 24 hours, Parth Chaturvedi, Investments Lead, CoinSwitch Ventures said, “Bitcoin is hovering around $43,000—a level which seems to be building as a support.”

“In other news, the labour market strength in the US saw a positive development as the country beat economist predictions and maintained the unemployment rate at 3.7 per cent, as opposed to an expected 3.8 per cent,” added Chaturvedi.

Edul Patel CEO of Mudrex said, “Bitcoin’s price is driven by a Federal Reserve adopting a hawkish stance and Bitcoin outflows from Grayscale. The failure to break above $43,800 led to a correction, but bulls are holding their ground, keeping Bitcoin above the $40,000 threshold. Despite a 35 per cent drop from its all-time high, Bitcoin has surged by 83 per cent since February of the previous year. Conversely, Ethereum is currently trading at $2,200.

Sharing the market outlook for the market today, Vikram Subburaj, CEO, Giottus said, “Bitcoin has closed the week with a marginal gain but there is no bullish bias yet as any move above $43,000 is met with selling pressure. It is consolidating in a tight range currently with its weekly MACD about to become bearish. A move towards $45,000 is possible once $43,000 is taken but bulls have to step in strongly to achieve this.”

“Key altcoins have played in line with Bitcoin with Solana, Cardano and Avalanche losing 3-4 per cent on weekly timeframes. With the US Fed now expected to hold interest rates for longer, BTC’s consolidation will likely lose stream sometime this month. Key support targets for altcoins today: Ethereum ($2,250), Solana ($92), BNB ($290), Avalanche ($32) and Cardano ($0.45).” added Subburaj.

Shivam Thakral, CEO, BuyUcoin, said “The crypto market has once again shown a weakness with Bitcoin hovering around the $42,000 support amid the failure of any breakout over the weekend. A breakout above $44,000 is still expected and could potentially mark the beginning of a rally towards new yearly highs. The Bitcoin halving, which occurs every 4 years, is less than 70 days away, and has historically pushed Bitcoin and the total market cap to new highs.”