Ireland’s technical recession over as GDP rises in Q1 2024

Newsflash: Ireland has escaped a technical recession, after its economy returned to growth this year driven by its IT sector.

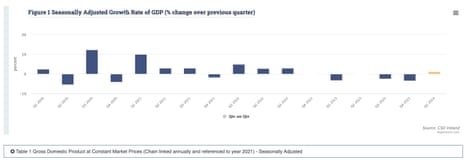

Ireland’s GDP is estimated to have risen by 1.1% quarter-on-quarter in January-March, new data from the Central Statistics Office shows. Growth was driven mainly by an increase in the Information & Communication sector.

That follows a 3.4% tumble in GDP in the final three months of 2023.

Enda Behan, statistician in the National Accounts Data Collection and Quality Division, said:

“In today’s release, GDP is estimated to have expanded by 1.1% in Q1 2024 in volume terms when compared with Q4 2023.

This was driven by an increase in the multinational dominated sector of Information & Communication in Q1 2024. GDP is estimated to have fallen by 0.8% when compared with the same quarter of 2023.

Ireland’s GDP fell in every quarter of last year, shrinking by 3.4% in Q1, 0.1% in Q2 and 2.5% in Q3.

But….GDP is not a very precise way of measuring the Irish economy, as it is dominated by multinational companies based in the Republic.

Ireland’s government favours another measures, called modified domestic demand, which excludes the large transactions of foreign corporations. Unfortunately we did not have new MDD data today.

Key events

PS: The London stock market has ended the day at a new closing high, just.

The FTSE 100 index has closed for the night up 7 points, or 0.1%, at 8147 points. That’s its latest in a series of closing highs.

Earlier in the session it nudged a new intraday high of 8189.14 points.

Closing post

Time to wrap up… here’s today’s main stories:

One in five Ocado shareholders oppose boss’s £14.8m package

Newsflash: Online grocery firm Ocado has been given a bloody nose by shareholders protest over its plan to give its CEO Tim Steiner a potential bonus of almost £15m.

But while one in five shareholders opposed the plan, it has been approved.

At today’s annual general meeting, 19.4% of shareholders opposed the approval of the Directors’ Remuneration Policy.

Another resolution, to approve the Ocado Performance Share Plan 2024, was passed with 80.62% votes in favour, and 19.38% against.

As we reported this morning, shareholder advisory group Glass Lewis had urged investors to vote against Ocado’s remuneration policy and performance share plan, citing “egregious remuneration practices”.

Campaign group ShareAction planned to ask Ocado’s board why it was comfortable proposing the multimillion-pound pay package for Steiner while “refusing to pay hundreds of its workers a real living wage of £12 an hour”.

Under Ocado’s pay plan, Steiner could receive a bonus worth up to 1,800% – or an “enhanced multiplier” – of his £824,570 base salary if its share price hits £29.69 in three years’ time and other performance targets are met.

Ocado shares hit £29 during the pandemic when online shopping surged, but have since fallen, trading at 357p today.

He would receive an award worth 600% of his base salary, or almost £5m, if targets for total shareholder returns and other performance measures are met but the share price goal is missed.

BHP and Vale propose $25bn reparations to settle Mariana disaster

In the mining sector, BHP Group and Vale are proposing a $25.7bn settlement over Brazil’s worst environmental disaster, the Mariana dam failure.

The collapse of the Fundão tailings dam in November 2015 killed 19 people, polluted a river and devastated livelihoods downstream of the Samarco Mariana Mining Complex.

The dam was co-owned by Vale and BHP, through their Brazilian joint venture Samarco; they have been negotiating with the Brazilian State and Federal Government and other public entities.

Today, they say:

As part of the settlement negotiations, BHP Brasil, Samarco and Vale have submitted a non-binding, indicative settlement proposal which is within BHP Brasil’s provision for the Samarco dam failure.

The proposal is for a total financial value of approximately R$127 billion (approximately US$25.7 billion) on a 100% basis with Samarco as the primary obligor and a 50% contribution from each of Vale and BHP Brasil as secondary obligors if Samarco cannot fund.

The new offer includes around R$37bn (US$7.7bn) already spent on remediation and compensation to date.

Tesla shares jump 12% after Musk’s Beijing trip

Shares in Tesla have surged 12% at the start of trading in New York, recovering some of their recent losses.

Investors appear to be pleased with Elon Musk’s weekend work in Beijing, where he secured a deal for Tesla to use mapping data provided by web search company Baidu.

Tesla Shares Up 10.7% After Clearing Key Regulatory Hurdles for Self-Driving in China

— DB News TradFi (@DBNewswire) April 29, 2024

That deal could be an important step towards Tesla introducing driver assistance technology in the world’s largest car market.

My colleague Jasper Jolly explains:

Baidu, which dominates web search in China, will provide mapping and navigation functions to help Tesla operate its driver assistance technology, which it calls “full self-driving”, or FSD, according to sources cited by Bloomberg News. Mapping services – crucial to driver assistance technologies – are strictly controlled by China’s government.

Despite its name, FSD does not provide autonomous driving abilities: it requires a driver who has “hands on the wheel and is prepared to take over at any moment”. However, launching it in China could help Tesla in the fierce competition for market share in the country, and provide more income. It costs $8,000, or $99 (£80) a month, although it is not available in many countries.

As covered earlier (8.06am), Musk also met with China’s premier, Li Qiang, during an unexpected trip to the Chinese capital.

Tesla’s shares are still down 25% so far this year, but have been recovering since mid-April when they sunk to around $140 each, amid concerns over slowing sales.

Kristalina Georgieva then warns that Europe is facing two problems – low growth and high debt.

She explains:

Problem one: growth. Our World Economic Outlook shows the global economy converging back to a rather weak trend rate of growth. Yes, the US economy still looks like it’s firing on all cylinders, but that is unlikely to last. In China, real-estate issues weigh on the outlook. In Europe, productivity growth lags behind, reflecting much less private investment in new technologies than in the United States. This is why we say it is vital to pursue structural reforms and scale-up innovation and investment. Europe needs faster productivity growth, and that means reforms—including transformational ones in the energy and digital arenas, and the completion of the single market.

🇪🇺🇺🇸💸⚡️-

US economy does not have long to demonstrate high rates of its current activity -IMF head Kristalina Georgieva.

“The US economy is still running at full capacity, but it is unlikely that this will last,” she said in her opening speech the budget conference.#EU–#USA

— Millitary Nerd (@MilitaryNerdd) April 29, 2024

Problem two: debt. After two massive shocks—the pandemic and the energy-supply shock caused by Russia’s invasion of Ukraine—many countries are shouldering very heavy public debt burdens. This is why we say many countries must now pursue judicious, wellarticulated medium-term fiscal consolidation to rebuild buffers— appropriately tailored to country specifics, of course.

This is “not a great place” to start a big push to develop clean energy supply and fight climate change, Georgieva cautions, adding:

But let us be clear: if we do not win the fight against climate change, all of humanity together, we will all suffer.

IMF’s Georgieva hails falling eurozone inflation

Over in Brussels, the head of the International Monetary Fund has welcomed signs that inflation is easing in the eurozone.

Kristalina Georgieva, IMF managing director, is addressing the Annual EU Budget Conference, and begins by hailing easing inflation.

Georgieva says:

The global environment. When we stare out at the horizon, what do we see?

I see a hint of sunshine. But I also see a dull grey sky and some dark clouds.

Let me start with the sunshine. After a global burst of inflation to levels many people have never seen in their lifetimes, it looks like the ECB’s tight monetary policy is doing its work.

This is something I need to say carefully because it’s not over yet. But, yes, it looks promising: inflation down from its disturbingly high peaks and no deep recessions in Europe.

Georgieva then warns, though, that the forget though, that “the last mile can be the hardest” in the fight against inflation.

No longer will the major central banks be marching in lockstep, as they did during the recent ratehiking cycle. No. From now on, each currency zone will have to chart its own path. An interest rate divergence looms, and maybe some exchange rate movements too.

We save the champagne for later.

Over at Heathrow Airport, members of Border Force have set up a picket line as a four-day strike in a dispute over working conditions.

The Public and Commercial Services (PCS) union said more than 300 of its members will take part in the industrial action, which started at 5am today and will continue until 7am on Friday.

The union said the workers, based at Heathrow’s Terminals 2, 3, 4 and 5, are protesting at plans to introduce new rosters they claim will see around 250 of them forced out of their jobs at passport control.

PCS general secretary Fran Heathcote said:

“It’s disappointing that, despite talks last week, the Home Office is not prepared to grant any flexibility to their new roster.

“None of our dedicated and highly experienced members in the Border Force want to take strike action but the way they’ve been treated by their employer leaves them with no option.

“The Home Office still have time to prevent tomorrow’s strike if they agree to abandon this unworkable new system.”

German harmonised inflation rises to 2.4%

Just in: German inflation rise slightly this month.

On an EU-harmonised basis, German consumer price inflation rose to 2.4% this month, up from 2.3% in March.

On a non-harmonised basis, though, German inflation was flat at 2.2%, with services inflation slowing to 3.4% but goods inflation rising to 1.2%.

Core inflation, which strips out food and energy, eased to 3% in April from 3.3% in March.

German CPI data comes in slightly below expectations:

• CPI inflation comes in at 0.5% MoM and 2.2% YoY (vs 0.6% MoM and 2.3% YoY expected) in Apr, unchanged from Mar.

• Core CPI inflation eases from 3.3% YoY in Mar to 3.0% YoY in Apr.

• Services inflation at 3.4% YoY (prev… pic.twitter.com/nhsL62LdU2— MTS Insights (@MTSInsights) April 29, 2024

Spanish inflation rises after energy support cut

Inflation in Spain has risen, as Madrid’s government cut back support for energy bills.

Spanish consumer price inflation rose to 3.3% per year in April, up from 3.2% in March.

Inflation was pushed up by gas prices – which rose this month but fell in April 2023 – after Spain’s government stopped measures taken to ease rising inflation after Russia’s invasion of Ukraine two years ago.

Food prices also rose.

Core inflation, which strips out food and energy prices, fell to 2.9% from 3.3% in March.

This data, and Germany’s CPI report due in half an hour, will feed into the latest eurozone inflation data due at 10am tomorrow.

Ireland’s return to growth is a sign that tomorrow’s eagerly-awaited eurozone GDP report may bring good news.

Economists predict the eurozone returned to modest growth in Q1 2024, after shrinking slightly in the second half of last year (GDP fell by 0.1% in both Q3 and Q4 2023).

Ireland’s 1.1% growth, and the 0.3% recorded in Belgium this morning, will help that return to growth.

Analysts at Investec said last Friday:

Recent revisions now mean that the Eurozone was in a technical recession in H2, albeit by the slimmest of margins.

Given that economic data at the start of 2024 has been more positive, we expect the Eurozone exited that recession in Q1, with a 0.1% quarterly expansion in output.

Ireland’s economy partially rebounded in the first quarter, a gain that may have helped the euro zone as a whole exit a shallow recession https://t.co/PuXte7ZQaY

— Bloomberg Economics (@economics) April 29, 2024

Ireland’s technical recession over as GDP rises in Q1 2024

Newsflash: Ireland has escaped a technical recession, after its economy returned to growth this year driven by its IT sector.

Ireland’s GDP is estimated to have risen by 1.1% quarter-on-quarter in January-March, new data from the Central Statistics Office shows. Growth was driven mainly by an increase in the Information & Communication sector.

That follows a 3.4% tumble in GDP in the final three months of 2023.

Enda Behan, statistician in the National Accounts Data Collection and Quality Division, said:

“In today’s release, GDP is estimated to have expanded by 1.1% in Q1 2024 in volume terms when compared with Q4 2023.

This was driven by an increase in the multinational dominated sector of Information & Communication in Q1 2024. GDP is estimated to have fallen by 0.8% when compared with the same quarter of 2023.

Ireland’s GDP fell in every quarter of last year, shrinking by 3.4% in Q1, 0.1% in Q2 and 2.5% in Q3.

But….GDP is not a very precise way of measuring the Irish economy, as it is dominated by multinational companies based in the Republic.

Ireland’s government favours another measures, called modified domestic demand, which excludes the large transactions of foreign corporations. Unfortunately we did not have new MDD data today.

Eurozone economic sentiment weakens

Just in: economic sentiment has fallen marginally in the EU and the euro area, as Europeans fret about their employment prospects.

The Economic Sentiment Indicator declined in the EU (by 0.3 points to 96.2) in April, and by more within the eurozone (where it fell by 0.6 points to 95.6).

The employment expectations gauge fell slightly more sharply.

Confidence among industrial firms, and among services companies, both fell; consumer confidence inched up, but remained in negative territory.

Within individual countries, economic sentiment deteriorated significantly in France (-4.8 points) and more moderately in Italy (-1.3 points), while it improved markedly in Spain (+2.3), Germany (+1.5) and Poland (+1.5).

The ESI remained broadly stable in the Netherlands (rising by 0.3).

Tomorrow we learn whether the eurozone returned to growth, when GDP data for the first quarter of 2024 is released….

Belgium’s economy has continued to grow at a modest pace, new data from its central bank shows.

Belgian GDP rose by 0.3% in January-March, the fourth quarter in a row in which a 0.3% expansion was recorded.

Both industry and services grew by 0.3%, while the construction sector shrank by 0.2%.

Sweden’s economy has shrunk for the fourth quarter in a row, leaving it in recession.

Swedish GDP shrank by 0.1% in the first quarter of 2024, Statistics Sweden reported this morning.

Mattias Kain Wyatt, economist at Statistics Sweden, says:

“Swedish economic activity continued to weaken in the first quarter of 2024 with contractions in the months of February and March. This is the fourth consecutive quarter with negative growth.”

Marc Ostwald, chief economist & global strategist at ADM Investor Service, says the data is much weaker than expected.

Sweden’s economy is in a poor run; GDP contracted by 0.8% in April-June 2023, then by 0.3% in July-September 2023, followed by a 0.1% contraction in October-December.