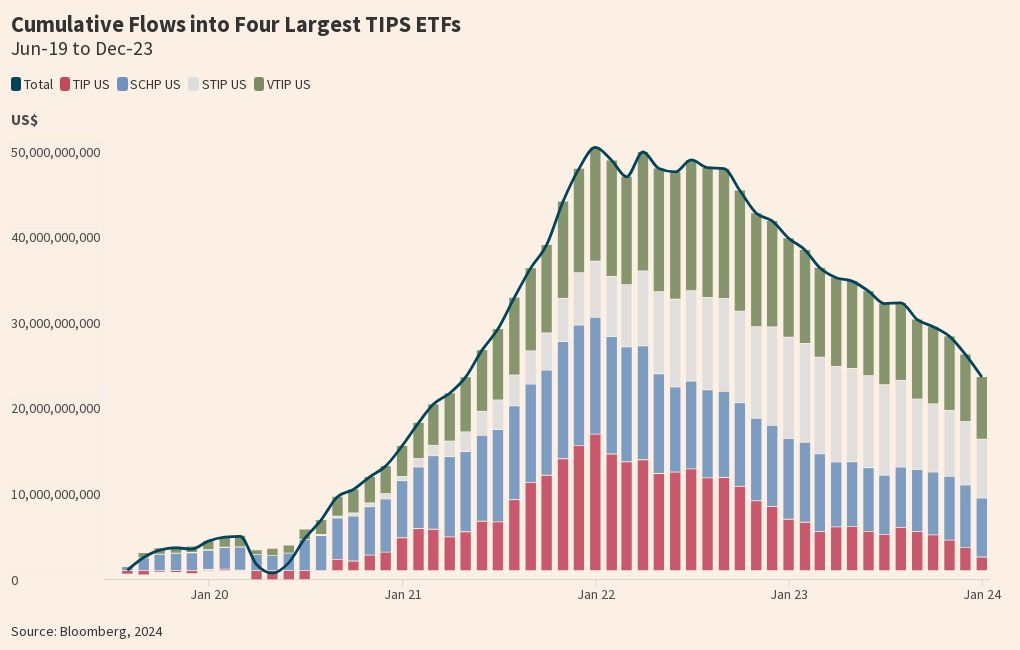

In 2020-2021, as the spectre of inflation grew closer, money flooded into TIPS ETFs. Here’s a chart showing the approximate cumulative flows into the two largest whole-of-market TIPS ETFs.

We can’t be sure, but it seems reasonable to infer that this was because people reckoned TIPS might … protect them against inflation?

This is not the most absurd investment thesis we’ve come across. In fact, here is what the US Treasury’s direct-to-retail bond portal has to say about Treasury Inflation Protected Securities (TIPS):

“As the name implies, TIPS are set up to protect you against inflation.”

It’s a lovely notion, but, come 2022, TIPS did not protect you against inflation.

Holders lost a ton of money in both nominal and real terms. If you squint, you can make out that the TIPS market performed a tiny-teeny bit better than the nominal US Treasury market. But dropping close to 20% in the inflation-adjusted value of your capital was maybe not plan A of the $30bn of money that rushed into TIPS ETFs.

Now that the damage has been done, folks are ditching TIPs. This gives us an excuse to explain these weird instruments and why supposedly inflation-proofed bonds were an awful hedge against inflation. If this strikes you as a bit Captain Hindsight, check out what we wrote in FTMain back in 2017 precisely on this point.

How TIPS work

Mechanically, TIPS follow the so-called ‘Canadian model’ of inflation-linked bonds:

🧐 Principal is linked to an index ratio which zips up (and sometimes down) depending on a linear interpolation of monthly inflation reads (with a 3mth lag) for the life of the bond;

😎 Coupon is a fixed percentage of principal;

🤓 Principal is repaid at whatever is higher of par and the inflation-indexed ratio.

It all gets a bit fiddly once you really get into the weeds. But unless you’re trading or pricing TIPS in size, or with leverage, we probably don’t need to go there. Zooming out, there are maybe two really important things you need to know about TIPS: real yields and break-even inflation rates.

First up, TIPS — just like conventional US Treasuries — have a yield, and the yield is just a mathsy way of expressing the bond price. There’s a reason why yields [say it with us]…

In the case of TIPS we call this the ‘real yield’ because it’s the yield you can lock in over and above inflation if you hold the bond to maturity.

The chart below shows the conventional 10-year US Treasury yield in red and the 10-year TIPS real yield in blue. You can see that in mid-2021 the real yield got all the way down to -1.2 per cent. Buying 10-year TIPS at that point you would lock in returns of whatever inflation might average 2021-2031 minus 1.2 per cent per annum over the course of ten years. (This is different from getting a return of inflation minus 1.2 per cent in year one, then making the call as to whether to also take inflation minus 1.2 per cent in year two, etc.) The chart shows this blue line bouncing higher in 2022, and yields up = prices down = rubbish returns in 2022.

Second, TIPS real yields are almost always lower than conventional bond yields. The difference between the yields of an inflation-linked bond and a conventional bond that both mature around the same time is called the ‘break-even inflation rate’.

Why are TIPS yields almost always lower? Because the TIPS principal and coupons are indexed upwards when inflation is positive. This is awesome — way better than boring old fixed rate US Treasuries. How much better? The world’s money-weighted answer is given in the form of a price (and hence yield). The (shaded) gap between conventional US Treasury yields (red line) and TIPS real yields (blue line) is a measure of TIPS’ relative attractiveness versus conventional US Treasuries. Mathematically, it’s the average inflation rate that would equate the total returns of TIPS and conventionals over the bonds’ lives.

Bond folk love peering at break-even inflation rates. We’ve reproduced some in a clickable chart below for the bond-curious. Rather than endlessly pontificating over what market expectations of inflation really truly are, they allow you to just read out a number. You can even use whizzy maths to strip out the current business cycle, build a forward inflation rate yield curve and infer long-term structural inflation expectations (or, just use the hack of doubling the ten-year break-even number and subtracting from this the five-year break-even to get to a pretty good approximation of the five-year five-year forward inflation rate beloved of macro wonks). So much to talk about at parties!

Views you can use

Fundamentally, the break-even inflation rate confers an investment view on anyone in possession of an inflation view. Reckon that inflation will average 5% over the next five years? If the five-year break-even inflation rate is only 2.3% buy TIPS! Right?

Almost. But no.

Your inflation view does not (other than in special cases) give you an outright investment view as to the likely absolute performance of TIPS. It only gives you an investment view as to the long-term prospects for relative performance between conventional US Treasuries and TIPS. This is the kind of investment view that helps you make friends only with other ‘special’ people. To build a view around absolute performance of TIPS, you’ve got to focus entirely on the real yield: forget the break-even!

Putting all this wisdom into a handy 2×2 matrix format, the Central Bank of Malta summarises the price sensitivity of conventional (aka nominal) and inflation-linked bonds to moves in yields and breakevens as follows. The (+) and (-) denote positive and negative absolute price changes, and the (+/-) denotes a positive or negative absolute price change depending on whether real yields move more than break-evens. (Eg, if real yields rise by 100 bps but break-evens fall by 80 bps, nominal yields will rise by 20 bps meaning that nominal bond prices will fall, but nominals will outperform TIPS.)

The aftermath

It’s quite possible that $30 billion of ETF flows didn’t get confused by any of this. If, for example, you had a view back in mid-2021 that inflation would turn out higher than break-evens, and that real yields would also stay negative, TIPS made a lot of sense.

It’s actually quite easy to paint such a scenario. Let’s say that inflation takes hold but the Fed is persistently too slow in raising rates, maybe because it looks through short-term supply shocks that keep on coming one after the other, or maybe because the economy goes all stagflationary and, when pressed, the Fed prioritises supporting demand rather than crushing inflation — and this drags on and on.

Whatever. It didn’t work out.

Instead, when inflation rose the Fed increased rates. This pushed nominal yields higher and — given that the rate hikes sent the message that the Fed’s intermediate goal of delivering price stability was pretty much intact — it also steadied break-evens, meaning that real yields were pulled higher, pushing prices lower and delivering negative returns despite the tailwind from principal and coupon inflation indexation.

Would short-maturity TIPS have been a better inflation hedge? This would’ve been our guess. Short-dated bonds have a lower price sensitivity to yield movements but their principal and coupons still benefit from full inflation-indexation.

Looking at flows into and out of the two largest short-dated TIPS ETFs, maybe $20 billion of money had this idea? Sadly, these 0-5 year US TIPS lost almost 9% in real terms in 2022. Which is to say they didn’t really work out for their holders either.

How does the story end?

Around $30 billion has fled the four largest TIPS ETFs since peaking at the end of 2021. But real yields are much higher today than they were, and break-evens are middling compared to their long-run history. As such, the absolute return outlook for the remaining $20 billion cumulative net inflows into the largest ETFs looks much better than it did at the end of 2021. Paradoxically, this is because the kind of inflationary threat that may well have attracted inflows looks like it has ebbed away.