Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

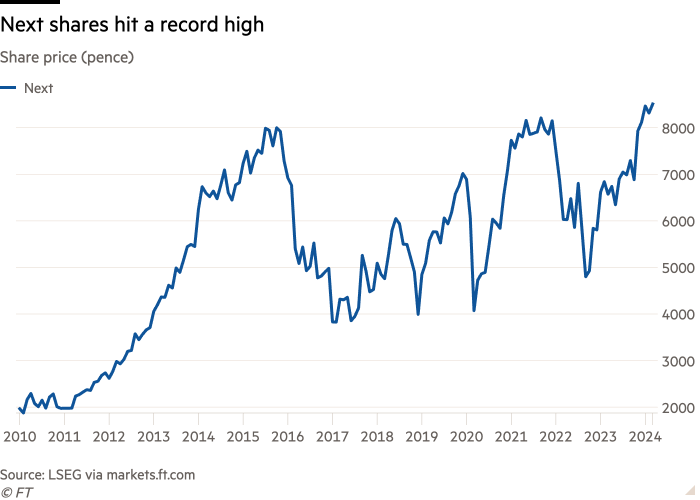

The head of bellwether retailer Next has said the outlook for UK consumer confidence was the best he has seen in seven years, as pay rises encourage shoppers to spend, sending its shares to a record high.

Shares in the FTSE 100 clothing chain rose 5 per cent after it reported a larger than expected rise in pre-tax profits. “It has been a long time since we started a year in a more positive frame of mind,” said chief executive Lord Simon Wolfson.

Pay rises, which are currently tracking above inflation, would ease the pressure on shoppers’ finances and be “good for sales” this year, said the long-standing chief executive.

“If you look at where we are today, compared to any of the last seven years, the headwinds are just not nearly as strong,” he said in unusually upbeat comments, but cautioned that “[this] shouldn’t be misinterpreted as a wild optimism” just because pressures on the business from the pandemic and the cost of living squeeze were subsiding.

“The consumer environment looks more benign than it has for a number of years, albeit there are some significant uncertainties,” Wolfson said.

Next is widely considered to be one of the best retailers in the UK by industry analysts, having deftly adapted to the shift to online shopping and responded to global crises while many of its peers have disappeared from the high street.

“The company is a high-class act with a deserved equity capital market following because there is a more than reasonable chance that it will beat its guidance,” said Clive Black, a retail analyst at Shore Capital.

Separately, Wolfson called on the government to close a loophole that typically allows fast-fashion disrupters such as Shein and Temu to avoid custom duties by shipping items directly from factories overseas.

On Thursday Next reiterated an earlier forecast that it expected to make a pre-tax profit of £960mn this year on a 2.5 per cent increase in full-price sales. For 2023, the company reported a larger than expected rise in pre-tax profits, which increased by 5 per cent to £918mn.

The company cautioned, however, that rising wages would probably result in “reduced employment opportunities in the wider economy”.

Wages are rising faster than prices, according to official data released earlier this week. Annual inflation fell to 3.4 per cent in the year to February, the lowest since 2021, while average earnings including bonuses were 5.6 per cent higher in the three months to January than a year earlier.

Wolfson said Next had been able to sell more of its pricier items as “there appears to be something of a shift back to investment dressing with customers buying somewhat fewer, slightly more expensive items”.

“Last year was much better than we anticipated at this time last year, and the group has delivered its highest ever levels of revenue and profit,” Wolfson said. “Perhaps more encouragingly, we enter the financial year with new avenues of growth along with a cost base that feels under control.”

Next’s largest cost increase this year will be wage inflation, the company said, at about £60mn. Within this, about £25mn will be the difference between the expected rate of general UK wage inflation and the rise in the national living wage next month.

Shares in Next were up 5 per cent in afternoon trading, giving the company a market capitalisation of £11bn. The shares have climbed 30 per cent in the past 12 months.