Introduction: Bank of England’s Andrew Bailey says rate cuts ‘in play’

Good morning, and welcome to our rolling coverage of business, the financial markets and the economy.

A day after leaving UK interest rates on hold again, the governor of the Bank of England has dropped a hint that cuts are coming.

Andrew Bailey has declared that rate cuts will be “in play” at future meetings of the BoE Monetary Policy Committee amid signs that tighter policy had quelled the risk of a wage-price spiral.

The Bank has been worried for many months that inflationary expectations will become embedded in the economy. But in an upbeat interview with the Financial Times, Bailey says:

“It’s like the Sherlock Holmes dog that doesn’t bark. If the second-round effects don’t come through, that’s good because monetary policy has done its job.

We have an increasingly positive story to tell on that.”

Bailey pointed out that the global shocks that pushed up UK inflation to the highest since the 1970s are now unwinding.

He was speaking after the BoE left interest rates at 5.25%, with two BoE policymakers dropping their calls for even higher borrowing costs. The Monetary Policy Committee voted 8-1, with Swati Dhingra continuing to vote, alone, for a cut in rates.

The financial markets now predict the first cut will come by June, with a cut at the next meeting in May seen as a 23% chance, according to the money markets this morning.

Some economists think the Bank could wait until August to start cutting. At least three quarter-point rate cuts are priced in by the end of the year.

Gabriella Dickens, G7 economist at AXA Investment Managers, says:

A decision of when to ease will be finely balanced between June and August, but on balance we now see the first move as more likely in June. We continue to expect two further 25 basis points (bps) cuts in November and December.

Bailey told the FT that he feels it is “not unreasonable” for the financial markets to expect rate cuts this year.

And, ssked if all the upcoming MPC meetings were live when it comes to possible policy moves, he confirmed:

“All our meetings are in play. We take a fresh decision every time.”

Hopes of global interest rate cuts this year triggered a market rally yesterday – with the UK’s FTSE 100 jumping 1.9% to a near one-year high. Wall Street hit record highs, again.

The agenda

-

9am GMT: IFO survey of Germany’s business climate

-

10.30am GMT: Bank of Russia sets interest rates

-

11am GMT: CBI Industrial Trends survey of UK manufacturing

Key events

Ouch. The pound has now dropped below the $1.26 level, as rate cut expectations weigh on the currency.

Sterling has now hit $1.2582, the lowest since 20 February.

Morgan Stanley predict the Bank of England will cut interest rates by a whole percentage point during 2024, which would bring Base Rate down from 5.25% to 4.25%.

In a research note this morning, following yesterday’s BoE rate decision, they say:

For the first time since September 2021, there were no votes for hikes at an MPC meeting.

The guidance was unchanged, but the minutes offered some interesting (dovish) shifts. We leave our call unchanged – May start, 100bp of cuts this year – but continue to acknowledge the risks of a later move. That said, after today, we have somewhat greater conviction that “later” means June and not August.

The key question, they add, is how many BoE members are very close to voting for a cut already, and how many require more than just one set of data prints to move.

The latter camp almost certainly includes [Catherine] Mann and [Jonathan] Haskel. for example, and [Megan] Greene, too. Indeed, with his term expiring in August, Haskel will almost certainly not vote for a cut in this cycle.

[Mann and Haskel both gave up voting for interest rate rises at this week’s meeting, meaning eight of the nine MPC members voted for no change.]

The pound has dropped to a three-week low this morning, as City traders anticipate cuts to UK interest rates soon.

Andrew Bailey signals to markets they are right to bet on more than one base rate cut this year but leaves them guessing as to when: “The fact that we have a curve that has CUTS in it for the year as a whole is not unreasonable to me.” Asked if all the upcoming MPC meetings were… pic.twitter.com/zZWOlw3HgO

— Emma Fildes (@emmafildes) March 22, 2024

Sterling has lost half a cent against the US dollar this morning, to trade just above $1.26, the lowest since 1 March, adding to yesterday’s losses.

UK Retail Sales 0.0% vs. Exp -0.3%#GBPUSD 1.2627 from 1.2619 lows, from highs yesterday of 1.2802

Sterling pairs dropped yesterday after the #BOE stated rate cuts are in play at future meetings pic.twitter.com/5yHFlCN59L

— ADSS (@adssgroup) March 22, 2024

Extremely wet February hit in-store sales

The dire wet weather that hit the UK last month hit spending in stores, as consumers avoided getting a soaking on the high street.

Heather Bovill, the ONS’s senior statistician, says:

Many shops told us that an extremely wet February reduced in-store sales.

But with people staying indoors, we saw a boost of 2.1% on the amount spent online.

February was certainly soggy; the south of England had its wettest February on record, in a series going back to 1836, according to Met Office data.

UK retail sales stagnated in February

Just in: retail sales volumes across Great Britain stagnated in February, new data shows.

The Office for National Statistics has reported that sales volumes were flat last month, following the strong 3.6% growth in January, after December’s slump.

That’s slightly stronger than expected, with economists forecasting a 0.3% drop in February.

The ONS says:

Sales volumes in clothing and department stores grew because of new collections but falls in food stores and fuel retailers offset this growth. Meanwhile online sales increased, particularly for clothing retailers, as wet weather affected footfall.

On an annual basis, volumes were 0.4% lower than a year ago, and were 1.3% below their pre-coronavirus (COVID-19) pandemic level in February 2020.

Retail sales saw no growth (0.0%) in February.

Sales increased in clothing and department stores as shoppers bought the new season’s clothes, but these were offset by falling food and fuel sales, with prices at the pump rising.

➡️ https://t.co/HiyLeXIpdw pic.twitter.com/64AGFh0EQJ

— Office for National Statistics (ONS) (@ONS) March 22, 2024

More broadly, sales volumes fell by 0.4% in the three months to February 2024 when compared with the previous three months.

And on an annual basis, retail sales volumes were 1.0% lower than in the quarter to February 2023.

UK consumers turn positive about their finances

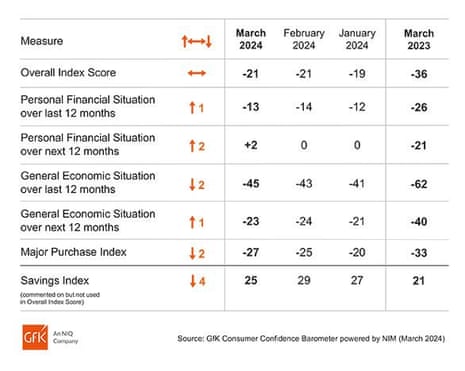

UK consumer confidence stalled in negative territory this month, but people are slightly more positive about their own finances.

The GfK consumer confidence index remained at -21 in March, unchanged from February, amid pessimism over the economic situation.

But households have turned positive about the outlook for their personal finances for the first time in more than two years. GfK’s index of personal finances over the next 12 months rose by two points at +2, which is 23 points higher than this time last year.

Joe Staton, client strategy director at GfK, says the improved Personal Finance measure is encouraging, adding:

This is welcome news given the challenges faced by Britons of fiscal drag, higher costs for fuel, rising council taxes and utilities eroding any increases in wages or other income.

Introduction: Bank of England’s Andrew Bailey says rate cuts ‘in play’

Good morning, and welcome to our rolling coverage of business, the financial markets and the economy.

A day after leaving UK interest rates on hold again, the governor of the Bank of England has dropped a hint that cuts are coming.

Andrew Bailey has declared that rate cuts will be “in play” at future meetings of the BoE Monetary Policy Committee amid signs that tighter policy had quelled the risk of a wage-price spiral.

The Bank has been worried for many months that inflationary expectations will become embedded in the economy. But in an upbeat interview with the Financial Times, Bailey says:

“It’s like the Sherlock Holmes dog that doesn’t bark. If the second-round effects don’t come through, that’s good because monetary policy has done its job.

We have an increasingly positive story to tell on that.”

Bailey pointed out that the global shocks that pushed up UK inflation to the highest since the 1970s are now unwinding.

He was speaking after the BoE left interest rates at 5.25%, with two BoE policymakers dropping their calls for even higher borrowing costs. The Monetary Policy Committee voted 8-1, with Swati Dhingra continuing to vote, alone, for a cut in rates.

The financial markets now predict the first cut will come by June, with a cut at the next meeting in May seen as a 23% chance, according to the money markets this morning.

Some economists think the Bank could wait until August to start cutting. At least three quarter-point rate cuts are priced in by the end of the year.

Gabriella Dickens, G7 economist at AXA Investment Managers, says:

A decision of when to ease will be finely balanced between June and August, but on balance we now see the first move as more likely in June. We continue to expect two further 25 basis points (bps) cuts in November and December.

Bailey told the FT that he feels it is “not unreasonable” for the financial markets to expect rate cuts this year.

And, ssked if all the upcoming MPC meetings were live when it comes to possible policy moves, he confirmed:

“All our meetings are in play. We take a fresh decision every time.”

Hopes of global interest rate cuts this year triggered a market rally yesterday – with the UK’s FTSE 100 jumping 1.9% to a near one-year high. Wall Street hit record highs, again.

The agenda

-

9am GMT: IFO survey of Germany’s business climate

-

10.30am GMT: Bank of Russia sets interest rates

-

11am GMT: CBI Industrial Trends survey of UK manufacturing