Stay informed with free updates

Simply sign up to the UK interest rates myFT Digest — delivered directly to your inbox.

A number of UK lenders have announced mortgage rate increases in a sign that the race towards more competitive offers is slowing, as the prospect of imminent Bank of England interest rate cuts fade.

HSBC has become the latest lender to raise its residential mortgage rates following similar moves by Santander, NatWest and Nationwide in recent weeks.

The rise in mortgage costs as the cost of living crisis continues comes as Prime Minister Rishi Sunak seeks to show he is supporting homeowners ahead of the general election expected this year.

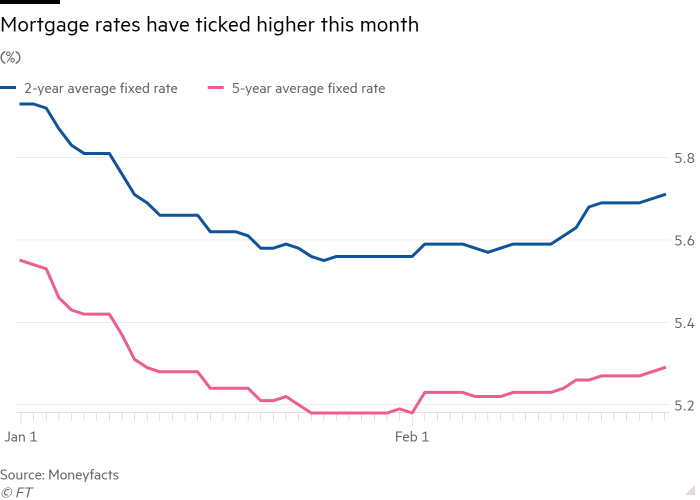

The average five-year fixed rate touched a low of 5.18 per cent around the end of January, but has since edged upward to 5.3 per cent, according to Moneyfacts data on Thursday.

The average two-year deal has followed a similar trend, up from 5.56 per cent to 5.71 per cent.

The uptick signals the end of a period of falling mortgage costs when lenders rushed to offer competitive deals, as the expectation of lower borrowing costs filtered through to the property market.

Brokers said that lenders faced very low margins and were sensitive to interest rate expectations.

“It doesn’t take very much movement in the market for the lender to go underwater and actually be losing money. That’s why they have to react so quickly,” said Simon Gammon, a mortgage broker at Knight Frank.

At the end of 2023 there was a rally in bond markets that prompted lenders to lower mortgage rates.

Analysts on Thursday said that mortgage offers would continue to fluctuate in the coming months in response to future market volatility.

“Sub-4 per cent deals will be off the cards temporarily, but once some positive data feeds back into the market, pricing will slowly edge back down,” said Nicholas Mendes, technical mortgage manager at brokerage John Charcol.

Data last week indicated that the UK economy slipped into a technical recession at the end of 2023 as gross domestic product fell 0.3 per cent in the final quarter. But business activity expanded more than expected in February, fuelling hopes that Britain’s recession could already be over.

In a sign of continued volatility, lender Halifax on Thursday bucked the trend by announcing it was set to cut the rates on its residential mortgage deals.

The changing economic outlook has driven up swap rates in recent weeks, which lenders use to price their mortgage deals. Swap agreements allow two parties to exchange payments, where one pays a fixed rate in exchange for a variable payment pegged to the Bank of England rate.

Two-year swaps — which correlate to the pricing of two-year fixed-rate mortgages — hit 4.58 per cent on Thursday, up from 4 per cent at the start of the year. Five-year swaps have risen from 3.4 per cent to 4 per cent over the same period.

Interest rates have stabilised after a long period of sustained increases, which is expected to give confidence to property buyers. The BoE raised the cost of borrowing from a record low of 0.1 per cent in November 2021 to 5.25 per cent last year in an attempt to tame the surge in inflation.