Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

There is a good reason why so many Americans — 1.6mn according to one estimate — work as real estate brokers or agents. The barriers to entry are low. No college degrees are required. The standard commission, 5 to 6 per cent of the purchase price, is split between the seller’s agent and the buyer’s agent. It is one of the world’s highest.

But a long overdue shakeout is looming.

In a seismic settlement last month, the National Association of Realtors (NAR), the all-powerful industry trade organisation, agreed to abandon a long-standing rule that requires home sellers to compensate the buyer’s agent. This has been required to list a property on a database known as the multiple listing service (MLS). The latter aggregates properties for sale regionally and is controlled by the NAR.

The deal still needs to be approved by a federal court. But it has the potential to drive down commission rates and force hundreds of thousands of agents out of the industry.

Home buyers and sellers will be the obvious winners. The changes could cut the $100bn Americans pay annually in real estate fees by as much as 30 per cent, according to a study by the Consumer Federation of America, a watchdog.

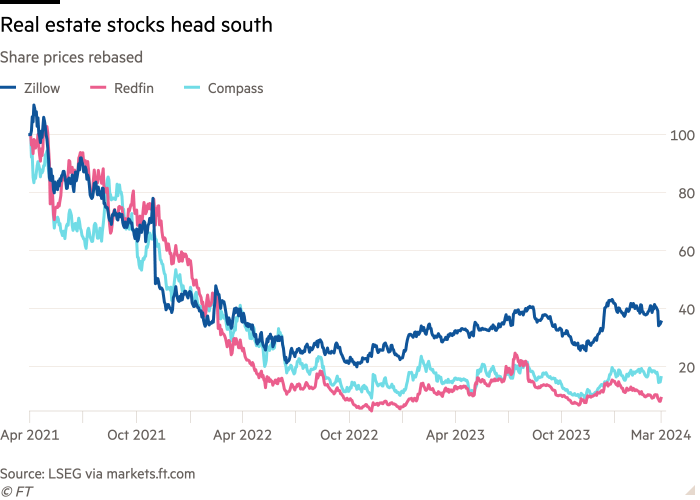

Figuring out which companies would suffer most from the drop in commissions is less clear. But that has not stopped investors from heading for the exit. Shares in online listing sites Zillow and Redfin are down 15 per cent and 33 per cent respectively this year. Real estate brokerage Compass is hanging on to a 2 per cent gain but remains down 83 per cent from its 2021 peak.

The buyside agent commission pool will fall the most. If buyers must decide whether to pay these brokers themselves, many may opt out. In countries such as the UK, France and Australia, buyers rarely use brokers.

Among the listed real estate companies, Compass looks most directly exposed. The buyside accounted for more than half of its transactions closed, according to analysts at Gordon Haskett. At Zillow, these commissions represented about 48 per cent of total revenue in the second half of 2023, said JPMorgan. At Redfin, the figure is a little lower.

Zillow and Redfin could benefit if more sellers decide to move their listings directly online. But they still need agents — particularly those who sell real estate as a side hustle — to stay put, rather than go the way of travel agents.