Martin Lewis discusses interest rates

Greedy high street banks will be forced to pass interest rate rises on to savers in a major victory for the Daily Express.

City watchdogs vowed on Monday to put customers first in a crackdown on the institutions which pay out the least.

Bosses were told to stop the rip-offs as savers failed to benefit from months of soaring rates.

The ultimatum comes in a new customer charter after a probe found big-name banks passed just 28 percent of interest rate rises to savers at a time they lined their pockets with record returns.

Sheldon Mills, executive director of the Financial Conduct Authority regulator, said: “We welcome the progress that has been made so far but this needs to speed up. We want a competitive cash savings market that delivers better deals for savers.”

While mortgage rates have shot up, returns on savings have not (Image: Getty)

The Bank of England raised its base rate to 5 percent in June – the highest since 2008 and the 13th consecutive rise – to try to drive down inflation. It is expected to go up again on Thursday.

But while mortgage rates have shot up, returns on savings have not. Banks and building societies will at last have to justify that position.

The promise of “robust action” by the FCA in its new Consumer Duty comes after the Express exposed the scandal of unjustifiably low savings rates for banks’ loyal customers.

The watchdog’s 14-point action plan aims to clamp down on those who have shortchanged millions at a time of deepening financial misery.

Firms offering the lowest savings rates will be made to justify by the end of this month how that is fair to savers. The FCA expects its intervention to mean fewer low savings rates, with banks obliged to let customers know about better deals. The City regulator urged savers to shop around and switch to more favourable offers.

The charter also cracks down on extortionate insurance premiums, making it easier to complain, and outlaws “unjustifiable fees” – long-time bugbears of despairing customers.

Mr Mills added: “We will be using the Consumer Duty to ensure this is the case – with firms required to prove to us that they are offering their customers fair value..”

Average two-year fixed mortgage rates are now up to 6.81 percent – but an average easy-access savings account pays out 2.78 percent while one-year fixed savings accounts typically are 5.19 percent.

The FCA action plan applies to all financial institutions including banks, building societies, insurers and credit card firms. The move follows a review of the limp cash savings market and a showdown with banks last month.

The watchdog found that while interest rates on savings have been rising, that has happened more slowly with easy-access accounts.

Average two-year fixed mortgage rates are now up to 6.81 percent (Image: Getty)

Nine of the biggest savings providers passed on only 28 percent of base rate rises to easy-access deposit accounts between January 2022 and last May.

Notice and fixed-term savings accounts have felt bigger rate rises, with the nine firms passing on 51 percent in the same period. But there has been a big variation between banks and building societies, with smaller providers often offering higher rates.

Rocio Concha, of consumer champions Which?, said: “The pace and scale at which rates are passed on to customers needs to be improved. In the midst of an unrelenting cost-of-living crisis it’s crucial those who are able to put money into savings accounts receive better returns.”

Martin Lewis, founder of MoneySavingExpert.com, said: “The new Consumer Duty for all financial firms hopefully upgrades rights from ‘being treated fairly’ to ‘customer always comes first’. They now must proactively look after customers. I’m supportive of the principle but wait to see how the reality plays out.”

Record low yields have meant that someone with £10,000 in an average easy-access savings account would earn interest of £278 a year – if the full BoE rate rise was passed on that figure would improve to £500.

The Consumer Duty sets higher, clearer standards for consumer protection. Banks, building societies, insurers and investment companies must focus on delivering “good outcomes” for customers.

It is seen as the biggest shake-up for financial services in years, ending hidden charges and ensuring institutions that offer savings accounts and mortgages inform clients of better deals. If they break the rules the FCA will take “robust action” including big fines.

The biggest banks have held on to billions of pounds from interest rate rises but failed to reward savers.

There are just 5,000 bank branches left on high streets – down from almost 10,000 in 2015 – sparking concerns that traditional over-the-counter banking might have disappeared by 2027, in yet another example of how customers’ needs have been ignored repeatedly.

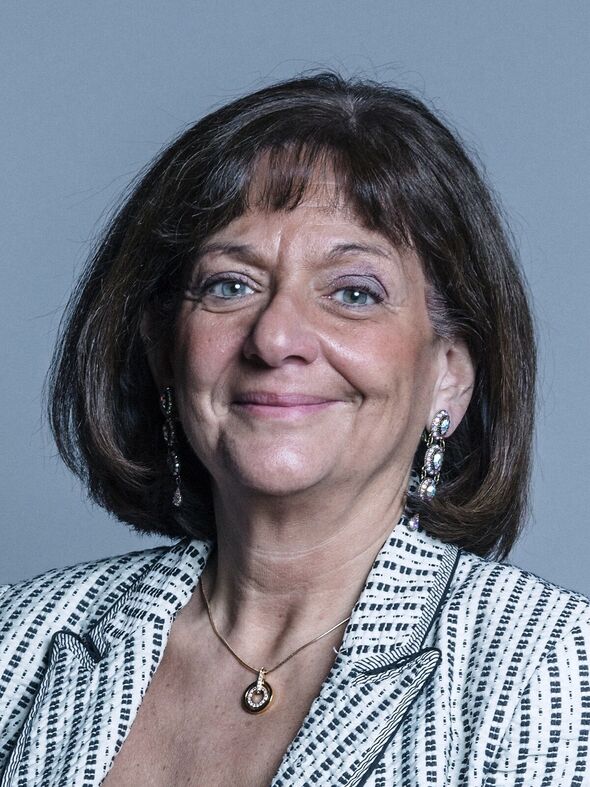

Baroness Ros Altmann, 67, who backs the Express crusade for fair play for savers, said: “Instead of prioritising profit, companies should consider customer needs as a whole.”

A poll revealed recently only 36 percent of adults agree that most finance firms are “honest and transparent”.

UK Finance, trade body for financial services, said: “Firms are committed to delivering good outcomes for customers and the Consumer Duty will reinforce these high standards.

“The principles of treating customers fairly, on which the Duty builds, have been in place for some time.

“Customers are therefore unlikely to see wholesale changes now the Duty has come into force, but may see clearer explanations of products.”

Martin Lewis (Image: Getty)

Banks continue low rates on savings

High street banks are paying rock bottom interest rates on savings, sometimes a little over 1 percent.

The paltry returns come as they continue to clobber homeowners with sky-high mortgage rates.

Borrowing costs soared after 13 consecutive Bank of England interest rate rises but savers have been hit for putting away.

On average, easy access saving accounts pay 2.45 percent but some hover around 1.5 percent, a lot lower than the 5 percent central bank rate.

One financial advisor told the Daily Express: “You may be able to find better rates in a fixed bond but with the cost of living so high, all savers are losing money.”

Barclays Everyday Saver pays an annual interest rate of 1.51 percent, Halifax’s Everyday Saver yields 1.65 percent, HSBC’s Flexible Saver returns 1.75 percent, while Lloyds’s Easy Saver pays a lowly 1.80 percent.

Meanwhile, Chorley Building Society pays an annual rate of 4.65 percent.

Paragon Bank’s Double Access Savings Account pays 4.60 percent, and Charter Savings Bank’s Easy Access returns 4.55 percent.

Inheritance tax is set to clobber an extra 50,000 families (Image: Getty)

50,000 more families will pay death tax

Inheritance tax is set to clobber an extra 50,000 families – almost four times more than first thought.

The Government has frozen the threshold at which the levy applies at £325,000 until April 2028, keeping it at the level set in 2021.

Previous estimates suggested 13,400 extra estates would be dragged into paying the duty.

However, the HMRC forecasts the number is now set to be 49,400, with higher-than-expected inflation blamed.

Inheritance tax receipts hit £2billion from April to June 2023, official data shows. This is £200million higher than the same three-month period in the last tax year.

Years of house price increases, soaring inflation and freezes have pushed an increasing number of families who would not consider themselves to be wealthy above the threshold.

Overall, more than 280,000 households face higher inheritance tax bills by the end of 2027-28 due to the seven-year freeze.

Individuals are currently allowed to hand down up to £500,000 tax-free to relatives, made up of a basic allowance of £325,000 plus £175,000 for property.

When one of a couple dies they can transfer their allowance to the other, meaning it is possible to bequeath up to £1million without triggering inheritance tax.

Anything above that threshold is taxed at 40 percent. Children typically have to pay the bill before probate is granted, often leaving them scrabbling to find cash.

The thresholds are meant to increase with inflation each year but successive chancellors have chosen to freeze them at their 2021 level to raise money.

Nicholas Hyett, investment manager at Wealth Club, said: “The breakdown of [HMRC’s] 2020-21 inheritance tax take shows a 17 percent increase in the number of estates paying inheritance tax, and an increase in liabilities for lower-value estates.”

He called freezing the thresholds a “sneaky attempt by the Government to grab more cash without taxpayers noticing”.

Baroness Altmann (Image: UK Parliament)

Q&A

The Financial Conduct Authority has set out a 14-point plan to ensure savings rates are being passed on appropriately.

The regulator will require firms offering the lowest rates to provide “fair value” evaluations under the consumer duty by August 31, 2023.

It will take “robust action” by the end of 2023 against those who cannot demonstrate fair value.

- What else is part of the action plan?

The FCA will review the timing of firms’ savings rate changes when there is a base rate change. The Bank of England base rate currently stands at 5 percent and it is expected potentially to rise again on Thursday.

The regulator will also publish an analysis every six months of firms’ easy access savings rates and it will look at the differences between on and off-sale savings deals, challenging firms to explain how big differences offer fair value.

- What does the FCA expect firms to do?

Firms should support customers to start a savings habit and find decent rates.

They should prompt savers with accounts which are paying little or no interest to consider what else is available.

- How does consumer duty fit into this?

It came into force on Monday and sets higher standards of consumer protection across financial services.

Firms will have to provide products fit for purpose, offer fair value and work as the customer expects.

They should also be able to justify pricing decisions.

It has come into force for new and existing products and services that are open for sale or renewal. It will be introduced on July 31 next year for closed products or services.

The FCA also said it expects savings providers to accelerate their fair value assessments for off-sale accounts ahead of the July 2024 consumer duty deadline for off-sale accounts.