Updated:

The FTSE 100 is up 0.6 per cent in afternoon trading. Among the companies with reports and trading updates today are Diageo, Saga, Pets at Home, WPP and SSP Group. Read the Tuesday 30 January Business Live blog below.

> If you are using our app or a third-party site click here to read Business Live

Sports Direct owner snaps up Wit Fitness

(PA) – Mike Ashley’s Frasers Group has bought sports performance brand WIT Fitness as it continues its investment spree.

Frasers Group, which owns Sports Direct and House of Fraser, said it had bought the assets and intellectual property of WIT Fitness, which is a specialist gym and fitness wear group.

WIT Fitness, which provides CrossFit training, has its headquarters in London and currently employs around 15 staff members.

CrossFit, founded in 2000, is a high-intensity fitness programme that has affiliations with 12,000 gyms worldwide, including WIT Fitness.

James France, the group head of acquisitions at Frasers Group, said: “We are pleased to have acquired the assets and IP of WIT Fitness, a globally recognised CrossFit and fitness performance brand.

“This acquisition supports our ambition to be a world-leading sports retailer, by bringing another elevated sports brand into Frasers Group’s diverse ecosystem.

“We look forward to investing in the future success of this globally recognised brand.”

SSP bolstered by sustained recovery in air and rail travel

Fintel makes sixth acquisition in 12 months

London-listed Fintel has bought Owen James Events for an undisclosed fee, marking the latest step in the growing fintech group’s acquisition spree.

Owen James is a platform for strategic engagement events across the financial services sector.

James Goad, Owen James’ managing director, will remain with the business, working closely with Fintel on a long-term strategy of growth and development, the group said.

Owen James is the sixth business acquired by Fintel, which is the parent company of SimplyBiz and Defaqto, during the past twelve months.

Join CEO of Fintel Neil Stevens said:

‘Owen James Events is renowned and respected as the premium independent platform for strategic engagement events for financial services professionals across the sector, and we’re proud to be a part of its future.

‘The acquisition of Owen James by Fintel will allow it to expand its already significant range of services, delivering education and strategic engagement opportunities to greater numbers of advice firms, wealth managers, paraplanners, mortgage brokers, and those in the private banking sector than ever before.’

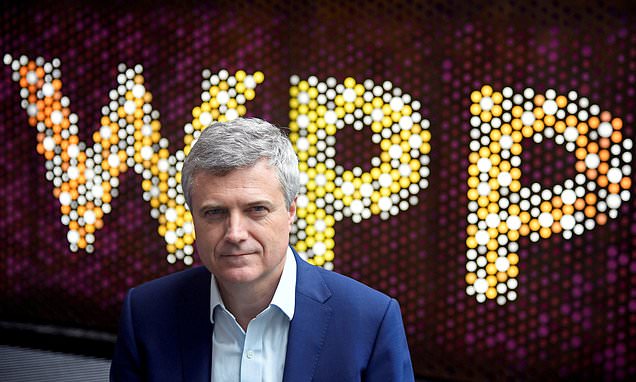

Ad group WPP to plough £250m into artificial intelligence

WPP has doubled down on its artificial intelligence (AI) bet in a bid to drive the advertising firm’s top line and improve margins in the medium term.

The group told investors on Tuesday it planned to plough £250million into AI this year, in a move it hopes will revolutionise the advertising sector and bolster its fortunes.

Speedy Hire shares plummet after profit warning

Speedy Hire shares fell sharply on Tuesday after the group cut its annual profit forecast, blaming weakness in the construction sector and a mild winter.

The group told investors full-year profits were set to come in below previous expectations, despite progress with its Velocity Strategy and new contract wins.

Spread your Isa across banks ahead of new rules at HL Active Savings

Savers can now split their Isa allowance between different types of cash Isa and different providers ahead of new rules.

From today, Hargreaves Lansdown’s cash platform Active Savings* will allow savers the opportunity to spread their Isa allowance across multiple banks, and across easy-access, limited access and fixed-term cash Isa products.

Are digital banks still just be used for secondary accounts?

There has been a huge leap in the number of Britons who have a current account with a digital-only bank, new exclusive data for This is Money suggests.

For the first time, more than a third (36 per cent) have an account with a bank that doesn’t have a physical high street presence, the research from comparison website Finder shows.

Pets at Home cuts profit forecast as shoppers buy fewer accessories

Saga profits more than double thanks to cruise demand

Saga expects annual underlying pre-tax profits to more than double, thanks to ‘outstanding’ performances by its cruises and travel operations.

The over-50s specialist has enjoyed a significant revival in demand in recent years, following the rollout of Covid-19 vaccinations and the loosening of travel restrictions across Europe.

BP urged to scale back green agenda: Investor blasts climate targets

‘It is shaping up to be a very busy week for markets’

Head of investment at Interactive Investor Victoria Scholar:

‘European markets have opened higher with the FTSE 100 leading the charge thanks to WPP which has surged over 5% on a positive trading update ahead of its capital markets day today.

‘Meanwhile Diageo has sunk to the bottom of the index after its first half sales fell short of expectations and HSBC is facing a fine of £57.4 million for failing to protect customer deposits.

‘Focus stateside later today will be on results from Alphabet, Microsoft, Snap, and Pfizer. It is shaping up to be a very busy week for markets with key earnings from US mega-cap tech as well as important central bank rate decisions from the Fed and the Bank of England.’

January sales price cuts help to drive inflation down to 2.9%

Diageo ‘performing comparatively well’ outside of Latin America and the Caribbean

John Moore, senior investment manager at RBC Brewin Dolphin:

‘Last year, Diageo warned about the impact challenges in Latin America would have on its results – so that comes as no surprise.

‘Overall, the business is performing comparatively well elsewhere against a challenging backdrop and tough year-on-year comparisons.

‘Today’s statement provides greater clarity following the shock from Latin America last year, which will hopefully turn out to be a blip rather than an enduring problem.

‘It’s been a difficult 12 months for Diageo, but there are reasons to be positive over the medium term, as the business continues to invest and the trading environment improves.

‘Longer term, the group remains very strong and well positioned to benefit from trends in the drinks and spirits industry, with ample room for growth in a highly fragmented market.’

Diageo profits suffer Latin America and Caribbean demand hangover

Diageo profits fell in the first half as the drinks giant continues to suffer sluggish demand in the Latin American and Caribbean (LAC) regions.

Reported operating profit fell 11.1 per cent year-on-year to $3.3billion (£2.6billion) in the six months to 31 December, with operating profit margin dwindling by 329 basis points to 30.3 per cent.

Organic operating profit slipped 5.4 per cent, but would have increased by 0.9 per cent if LAC was excluded, the Johnnie Walker maker said on Tuesday.

Debt-wracked Chinese property giant Evergrande to be wound up

Diageo serves up underwhelming first half

Aarin Chiekrie, equity analyst at Hargreaves Lansdown:

‘Diageo served up an expectedly underwhelming set of first-half results, leaving a bad taste in investors’ mouths.

‘The Guinness brewer has a strong portfolio of brands under its belt, including the likes of Smirnoff, Johnny Walker and Tanqueray. Despite the diversity of its drinks portfolio, the group measured a small revenue decline in the first half.

‘Diageo’s performance was held back by its stumbling Latin America and Caribbean region, where sales have been much weaker than originally anticipated. Against a strong comparable period last year, sales dropped by a staggering 23% as customers here have been consuming less and downtrading to cheaper alternatives.

‘Trading across the group’s other regions has remained positive, driven largely by price hikes. But given that the Latin America and Caribbean market is one of Diageo’s higher-margin territories, the sales decline is having an exaggerated impact on group profits, which tumbled 5.4% lower organically.

‘The profit outlook remains murky for the second half, with markets now forecasting a small decline in operating profit. The medium-term looks slightly brighter, but improvements in the Latin American and Caribbean market will be key to future margin expansion, and to a large extent, that’s outside of Diageo’s control.’

BAE gets a £370m boost as Kazakh airliner it backs prepares to list in London

Kazakh carrier Air Astana will be worth up to £757million when it lists in London next month, valuing BAE Systems’ stake at £370million.

The airline – owned by the British defence giant and Kazakhstan’s sovereign wealth fund – yesterday set the price range for its initial public offering (IPO).

Air Astana’s float will offer BAE Systems – which owns 49 per cent of the airline – a windfall, depending on how much of its stake it decides to sell.

SSP Group boosted by leisure travel rebound

SSP Group, which operates food outlets at airports and train stations globally, said on Tuesday it had started its new fiscal year strongly, buoyed by a rebound in leisure travel, and forecast travel demand to remain resilient.

The group, which earns more than two-thirds of its turnover from airports, said like-for-like sales in the three months to 31 December grew by14.3 per cent year-on-year.

The Upper Crust owner posted an over 14 per cent sales growth in its first quarter, buoyed by a rebound in leisure travel, and also forecast travel demand to remain resilient.

‘There continues to be encouraging momentum in our key growth markets of North America and Asia Pacific and we have also delivered double-digit like-for-like growth in our more established markets of the UK & Ireland and Continental Europe,’ CEO Patrick Coveney said in a statement.

Pets at Home trims guidance

Pets at Home Group has cut full-year profit expectations after its retail business saw growth below its expectations as customers cut back spending on accessories for their pets.

The group, which also offers grooming and veterinary services, said it expects underlying profit before tax to be about £132million for the year, compared with its previous target of about £136million.

‘Our colleagues came together over our peak trading period to deliver a record sales performance, growing against a very strong performance in the prior year.

‘While a slower market over peak meant our sales growth didn’t quite hit the levels we expected, the business remains well positioned to benefit from long term growth in the sector as we continue to win share and grow volumes across food and deliver differentiated performance through our unique vets business.

‘Importantly, we will shortly follow up launching our new distribution centre with the launch of our new digital platform, in line with our target.

‘Our new digital platform is a key foundation of our growth strategy, bringing vastly improved user experience to our consumers, and creating opportunities to improve cross-sell into accessories and further grow share of wallet. With these foundations now in place we are well positioned for the future.’

Ryanair profit hit amid row with travel agents and soaring fuel bill

Ryanair has trimmed its profit guidance for the year as it grapples with a higher fuel bill and an ongoing row with online travel agents.

The budget airline said it expects annual profits to hit £1.66billion, down from its previous estimate of £1.75billion.

This was a blow for chief executive Michael O’Leary, who is reportedly in line for a £85million bonus if the company posts a £1.8billion profit or shares hit a target of €21 for 28 days.

Saga profits more than double

Saga expects annual underlying profit to more than double year-on-year, with the over-50s specialist betting on retired and wealthy Britons being less impacted by the cost-of-living crunch to keep up travel demand.

The London-listed holiday and insurance company, expects full-year revenue growth of 10 to 15 per cent, it said.

For the 2022/2023 year, Saga reported underlying pre-tax profit of £21.5million.

In September, Saga had forecast double-digit growth in annual revenue and said underlying profits would beat market estimates.

Mike Hazell, Saga Group CEO, said:

‘For 2023/24, Saga remains on track to deliver significant growth in revenue, in addition to an underlying profit more than double that of the prior year1, exceeding our previous guidance.

‘Our Cruise and Travel businesses have had an outstanding year, having taken around 120k passengers on holiday, with customers continuing to be drawn to the strength of the Saga brand and offer.

‘As a result, these businesses will return to profitability, in line with expectations. In Insurance, the market-wide inflationary environment and declining policy volumes are continuing to impact our performance.

‘The year ahead will see a continuation of these trends across our business. Bookings for the new seasons in Cruise and Travel are robust, showing good overall progress.’

Paddy Power owner Flutter lists in New York in fresh blow to London

Paddy Power’s owner dealt another blow to London as it set out plans to switch its main listing to New York. Shares in Flutter started trading on Wall Street for the first time yesterday following a ‘secondary’ listing.

And the company used the occasion to reveal it is hoping to move its ‘primary’ listing across the Atlantic – downgrading its status in London in the process.

Diageo sales dip on Latin American slowdown

Diageo missed first-half sales estimates after the world’s largest spirits maker suffered a sharp decline in the key markets of Latin America and the Caribbean.

The maker of Johnnie Walker whisky and Tanquery gin reported a 0.6 per cent fall in organic net sales for the six months ended 31 December, slightly missing analyst estimates for flat organic sales.

Diageo warned in November that sales in Latin America and the Caribbean were set to decline by over 20 per cent amid a build-up of unsold stock in Mexico and Brazil, where drinkers were buying less premium spirits.

‘As previously announced in November 2023, materially weaker performance in LAC, driven by fast-changing consumer sentiment and high inventory levels, significantly impacted total business performance.

‘Having conducted a review of inventory levels and monitored performance in the critical holiday season, we have taken action and have further plans to reduce inventory to more appropriate levels for the current consumer environment in the region by the end of fiscal 24. This is a key priority.’

Share or comment on this article:

BUSINESS LIVE: Diageo sales dip; Saga profits soar; Pets at Home trims guidance

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.