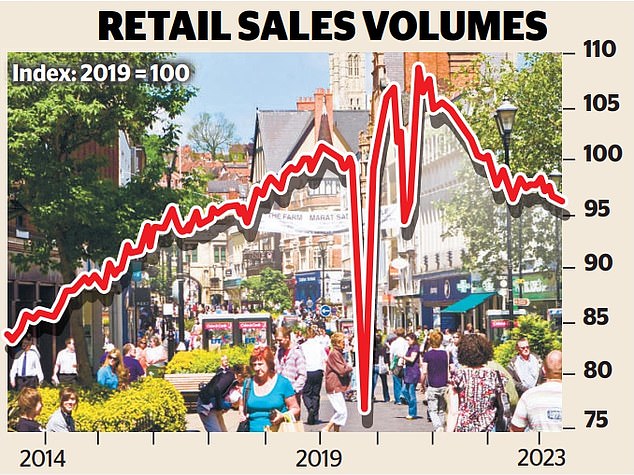

- ONS: Goods sold fell 0.3% in October following a drop of 1.1% in September

- That took sales volumes back to levels last seen in February 2021

- Chains hope Black Friday and Cyber Monday will get Christmas back on track

Gilt yields fell to six-month lows yesterday as investors ramped up bets on an early interest rate cut following a sharp decline in retail sales.

In a bleak update ahead of the crucial Christmas trading period, the Office for National Statistics said the amount of goods sold fell 0.3 per cent in October following a drop of 1.1 per cent in September.

That took sales volumes back to levels last seen in February 2021 when tough Covid lockdown restrictions were in place – hammering the High Street in the process.

After a grim start to the so-called ‘golden quarter’ for retailers, chains will be pinning their hopes on a bumper Black Friday and Cyber Monday at the end of the month to get Christmas back on track. The figures sparked renewed concerns about the health of the economy – piling pressure on Chancellor Jeremy Hunt to act in the Autumn Statement next week.

It also triggered fresh speculation over when the Bank of England will cut interest rates even as the central bank’s deputy governor warned further hikes may be required to tame inflation.

Bets on financial markets suggest there is a more than one in three chance of the first reduction coming in May and a near-70 per cent chance rates will have fallen from the current level of 5.25 per cent to 5 per cent or lower by June.

Those bets were reflected on the bond markets as the yield on ten-year gilts – a key measure of government borrowing costs – fell towards 4 per cent.

That was the lowest level since May and down from peaks of around 4.75 per cent in August when it was feared the Bank was readying to raise rates yet again.

Two-year gilt yields also fell below 4.5 per cent having been above 5.5 per cent in July.

Analysts said the slide in bond yields was likely to lead to further cuts in mortgage rates in a boost for millions of borrowers.

‘Where government bond yields lead, mortgage rates tend to follow,’ said Laith Khalaf, head of investment analysis at AJ Bell, adding: ‘Interest rate expectations are bouncing around like a jelly on a trampoline, and taking bond prices with them. Right now the market is getting excited about interest rate cuts, but it may yet be disappointed.’

Investors have been ramping up bets on rate cuts since official figures this week showed inflation fell sharply from 6.7 per cent in September to 4.6 per cent in October. It was the biggest drop since 1992. But inflation remains well above the 2 per cent target, prompting Bank of England officials to caution that an early rate cut is highly unlikely.

Bank officials have been battling to quash talk of early rate cuts with monetary policy committee member Megan Greene this week warning that financial markets globally ‘haven’t really clocked’ that borrowing costs will need to remain ‘restrictive’ for quite some time.

In a speech yesterday, deputy governor Dave Ramsden said he ‘would not rule out’ having to raise rates further if ‘more persistent inflationary pressures’ emerge.

The comments underlined the gulf between the rhetoric coming out of Threadneedle Street and the views of economists and traders.

A report by Goldman Sachs this week suggested rates could be cut as soon as February if the economy enters recession.

Victoria Scholar, head of investment at Interactive Investor, said: ‘While higher-for-longer interest rates appear to be the most likely outcome over the coming months, rate cuts look set to begin next year, bar any major spikes in inflation.’

The Bank has raised rates from a record low of 0.1 per cent to a 15-year high of 5.25 per cent in a desperate battle to bring inflation back under control. Inflation has fallen from a peak of 11.1 per cent in October last year to the current level of 4.6 per cent but remains above the 2 per cent target.

Martin Beck, chief economic adviser to the EY Item Club, said the fall in retail sales showed ‘the impact of higher interest rates is building’.